At A Heart 2 Help, we often encounter individuals caught in a frustrating financial paradox. They make too much for assistance but not enough to live comfortably, falling into what’s known as the “income trap.”

This situation can lead to significant stress and difficult choices for families and individuals. In this post, we’ll explore the challenges of the income trap and offer practical strategies to navigate it.

What Is the Income Trap?

The Financial Paradox

The income trap represents a financial predicament that affects numerous hardworking individuals and families across the United States. This situation occurs when a person’s income exceeds the threshold for government assistance programs, yet falls short of covering basic living expenses comfortably. As a result, people find themselves in a challenging position, struggling to make ends meet without access to necessary support.

The Structure of Assistance Programs

Most assistance programs in the U.S. use gross income as the primary eligibility criterion. For instance, the Supplemental Nutrition Assistance Program (SNAP) typically disqualifies applicants whose gross income surpasses 130% of the federal poverty level. This approach fails to account for the actual financial situation of many families after taxes and essential expenses.

The U.S. Department of Agriculture reports that in 2024, 8.9 percent of households with children experienced food insecurity for both children and adults. This statistic highlights the gap between income thresholds for assistance and the real financial needs of many Americans.

Common Scenarios of the Income Trap

A typical scenario involves a family of four with a gross income of $40,000 per year. This amount might exceed the threshold for various assistance programs, yet after taxes, rent, utilities, and healthcare costs, the family struggles to afford nutritious food or unexpected expenses.

Single-income households often face this trap due to medical needs or childcare responsibilities. In some cases, up to 95% of their income goes towards essential living expenses, leaving little to no room for savings or emergencies.

The Hidden Costs

The income trap doesn’t just affect finances; it impacts overall well-being. A survey by the Pew Research Center found that 60% of Americans say it’s harder now to afford basic expenses compared to five years ago. This financial stress can lead to health issues, strained relationships, and limited opportunities for education or career advancement.

Seeking Solutions

While changing eligibility criteria for government programs presents a challenge, individuals caught in the income trap can explore alternative solutions. Local community services, volunteer opportunities, and financial planning resources (such as those offered by A Heart 2 Help) can provide valuable support. These resources aim to alleviate some of the burdens associated with the income trap and help individuals navigate their financial challenges more effectively.

As we examine the income trap’s far-reaching effects, it becomes clear that this issue extends beyond mere financial strain. The next section will explore how this predicament impacts individuals and families on multiple levels, from their day-to-day lives to their long-term prospects.

Impact on Individuals and Families: The Hidden Toll of Financial Limbo

Chronic Stress: A Silent Killer

The income trap doesn’t just strain wallets; it profoundly impacts every aspect of life for individuals and families caught in this financial limbo. Financial instability breeds constant worry. A study revealed that higher financial worries were significantly associated with higher psychological distress. This chronic stress takes a physical toll, increasing the risk of health issues.

Health Takes a Back Seat

When every dollar counts, preventive healthcare often becomes a luxury. A survey found that about half of U.S. adults say it is difficult to afford health care costs, and one in four say they or a family member in their household had postponed or skipped care in the past year due to costs. This neglect leads to more severe health issues down the line, creating a vicious cycle of declining health and mounting medical bills.

Relationships Under Pressure

Financial stress is a leading cause of divorce, with money arguments being the strongest predictor of separation (according to a study in the journal Family Relations). Beyond romantic partnerships, the income trap can lead to social withdrawal. People may avoid social gatherings due to embarrassment or inability to afford activities, further isolating themselves from potential support networks.

Career Stagnation and Missed Opportunities

The income trap often forces individuals to prioritize immediate survival over long-term growth. A report from the Brookings Institution found that those caught in this financial predicament are 30% less likely to pursue additional education or training. This lack of career development perpetuates the cycle, making it harder to escape the income trap over time.

The Path Forward

While the impacts are severe, they’re not insurmountable. Community resources offer financial counseling and connections to local support services. Those who struggle should reach out – no one has to face this alone. The next section will explore practical strategies to navigate the income trap and work towards financial stability.

Breaking Free from the Income Trap

Master Your Money

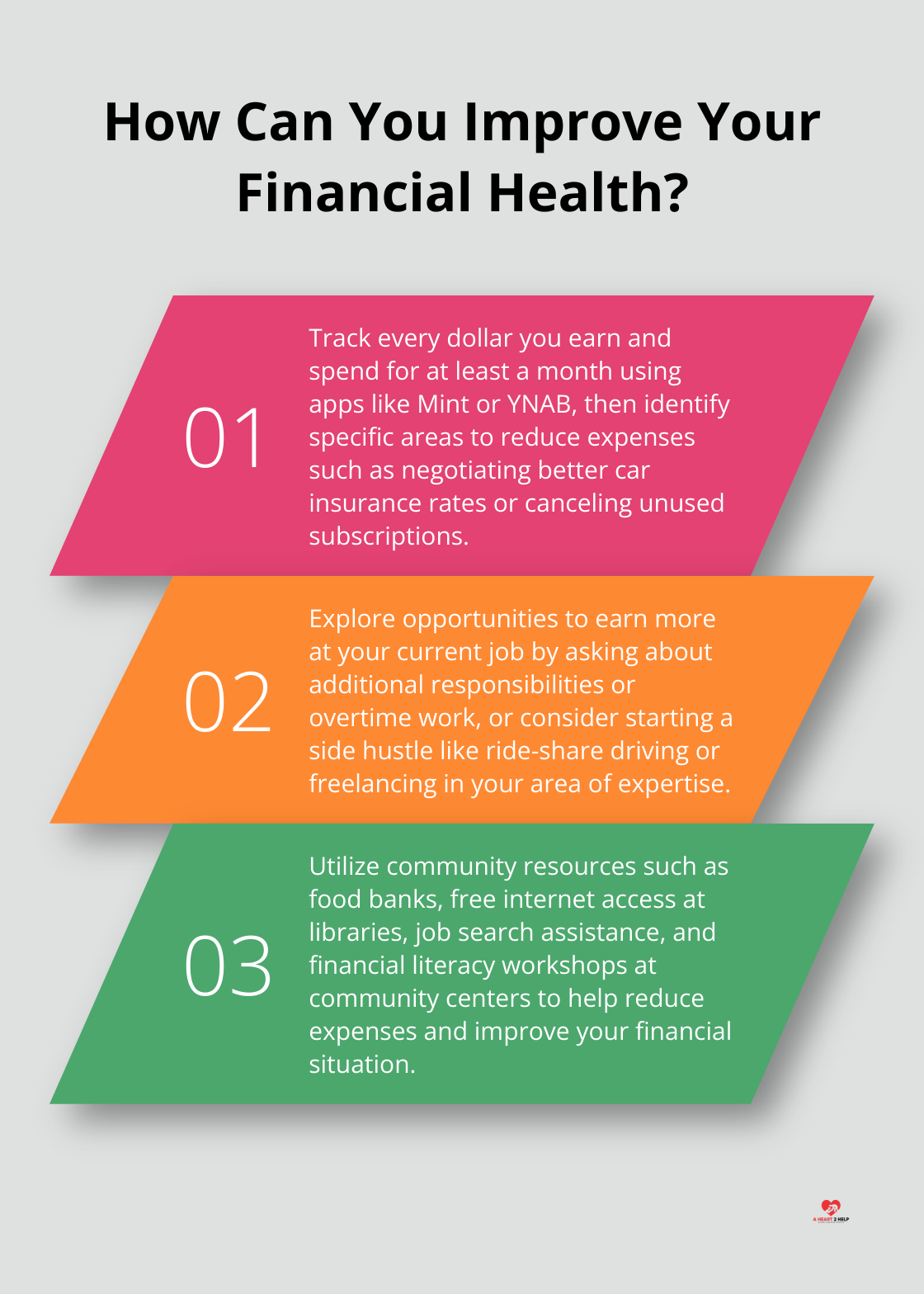

The first step to escape the income trap involves a clear understanding of your finances. Track every dollar you earn and spend for at least a month. Apps like Mint or YNAB (You Need A Budget) simplify this process. After collecting data, identify areas to reduce expenses. Consider negotiating better rates on car insurance or canceling unused subscriptions. Small savings accumulate over time.

Prioritize your spending next. The 50-30-20 rule provides a good starting point: allocate 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment. Adjust these percentages as necessary, but maintain the principle of intentional allocation.

Boost Your Income

Increasing your income often becomes necessary to escape the trap. Explore opportunities to earn more at your current job. Ask about additional responsibilities or overtime work. If these options aren’t available, consider a side hustle. The gig economy offers flexible options like ride-share driving or freelancing in your area of expertise.

Invest in your skills to improve your earning potential. Many community colleges offer affordable courses leading to certifications and better-paying jobs. Online platforms like Coursera or edX provide free or low-cost classes from top universities.

Tap into Community Resources

Your community likely offers more resources than you realize. Food banks serve not only those below the poverty line but also working families struggling to make ends meet.

Local libraries provide more than books. Many offer free internet access, job search assistance, and financial literacy workshops. Community centers may have low-cost childcare options or after-school programs to help working parents save on care costs.

The U.S. Treasury Department provides information on various assistance programs for American families and workers, including Economic Impact Payments, Unemployment Compensation, Child Tax Credit, and Emergency Rental Assistance.

Advocate for Change

While individual actions matter, systemic change addresses the income trap on a larger scale. Join local advocacy groups pushing for policies that tackle this issue. These efforts might include campaigns to raise the minimum wage, expand eligibility for assistance programs, or implement more progressive tax structures.

Contact your representatives at all levels of government. Share your story and push for policies that consider net income (rather than gross income) for assistance eligibility. The National Low Income Housing Coalition provides resources on effective advocacy for affordable housing policies.

Seek Professional Guidance

Consider consulting with financial advisors or credit counselors (many offer free or low-cost services). These professionals can help you create a personalized plan to improve your financial situation. They often provide insights into debt management, budgeting techniques, and strategies to build long-term financial stability.

Final Thoughts

The income trap affects many who make too much for assistance but not enough to live comfortably. This financial predicament causes stress, health issues, and limited growth opportunities. However, solutions exist, and no one must face these challenges alone. Community support and resources play a vital role in navigating this situation.

We at A Heart 2 Help understand the complexities of financial struggles. Our innovative care-app connects those in need with compassionate volunteers. We offer assistance ranging from rides to companionship. Anyone facing financial challenges should reach out and use our platform.

Proactive steps to manage finances, increase income, and seek professional guidance can make a significant difference. Implementing budgeting techniques, exploring side hustles, and developing skills help break free from the income trap. Community efforts and individual actions together create a more supportive and inclusive society.